In 2021, President and CEO Markus Rauramo had one joint Fortum Executive Management (FEM) target related to the progress in strategic priorities, and one individual target related to the co-operation with Uniper. The individual target was related to the progress in the strategic cooperation areas (Nordic hydro and physical trading optimisation, wind and solar, and hydrogen) and the progress in value creation and strategic portfolio development. The STI outcome of these joint FEM targets and the individual targets reached 64% of the maximum. According to the terms of the arrangement, fixed salaries of the Fortum Leadership Team will not be increased in 2022 and 2023, nor will members of the Leadership Team receive short or long-term performance bonuses for those years. Fortum published the Remuneration Report for the company’s governing bodies for 2022 on its website on 3 March 2023, and it was presented to the Annual General Meeting of Fortum held on 13 April 2023 in accordance with the Finnish Companies Act. After the meeting, Fortum’s new Board reassessed the implementation of the remuneration restrictions imposed by the Bridge financing agreement with the Finnish State last autumn and changed the interpretation made by the previous Board of Directors.

According to the purchase order issued by the Company, the shares were purchased within two (2) weeks following the release of the Company’s Interim Report for the period 1 January – 31 March 2022. Our advisers act on domestic and international projects of all shapes and sizes, working with many of the leading names in the market. Browse our experience below, or use the filters to look-up recent work in particular geographies and industry sectors. Members of the Fortum Leadership Team outside Finland participate in pension systems based on statutory pension arrangements and market practices in their local countries. In addition to the statutory pensions, the members of the Fortum Leadership Team have supplementary pension arrangements.

More Definitions of Director’s Remuneration

Therefore, the Board of Directors resolved earlier that the agreed deduction will be done from the LTI payment in spring 2024. As Markus Rauramo has decided to waive the LTI rewards from the 2020–2022 and 2021–2023 LTI plans and no LTI rewards shall be paid in 2024, Board of Directors resolved that the agreed deduction will be done from the incentive payments scheduled to be made in spring 2025. Generally speaking, if the director’s remuneration is too low, it will affect the enthusiasm of the directors, making them unwilling to supervise the management effectively, thereby reducing the company’s performance.

Leaked Microsoft memo tells managers not to use budget cuts as an explainer for lack of pay rises: ‘Reinforce that every year offers unique opportunity for impact’ – Fortune

Leaked Microsoft memo tells managers not to use budget cuts as an explainer for lack of pay rises: ‘Reinforce that every year offers unique opportunity for impact’.

Posted: Tue, 29 Aug 2023 14:48:00 GMT [source]

The precise tax treatment and other restrictions on directors remuneration may depend on both the country or state concerned, and on the legal structure of the business. Distinctions that can be important include whether or not the director is also a shareholder in the company, whether or not the director is performing other professional duties for the company such as acting in a direct management role. It may also make a difference whether or not the remuneration is entirely fixed or dependent on the performance of the company. One of the more complicated elements of directors’ remuneration is that it is made up of many different elements compared with ordinary employees. Often a basic salary is topped up with benefits such as healthcare insurance or retirement benefit plans. There can also be bonuses based on the company’s performance, payment in shares, or payment in the form of share options that allow the director to buy shares from the company at a fixed price that may be sold on the open market at a profit.

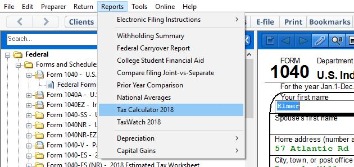

Long-term incentives (LTI)

President and CEO Markus Rauramo has decided to waive the LTI reward from the 2020–2022 LTI plan, thus no LTI reward shall be paid to Markus Rauramo in 2024. In 2022, President and CEO Markus Rauramo had two joint FEM targets and one individual target. These targets related to the structural changes in Fortum Group, various strategic projects and the review of Fortum Group strategy. The earned incentives for the year 2021 were paid in April 2022 based on the decision by the Board of Directors made in March 2022. Whilst people pursue board appointments for a wide range of reasons it is useful to know how much you might get paid. For many, you will soon recognise that a board appointment is not the financial gold mine you might have thought it would be.

The Board of Directors regularly reviews the performance of the President and CEO and other Fortum Leadership Team members. Fortum’s LTI programme consists of the annually commencing LTI plans with a three-year performance period. The relative TSR measured against a peer group of European utilities, has been the financial target in the LTI programme since 2019.

Remuneration of the Board of Directors

Disclosure of directors remuneration is increasingly regarded as good practice and is now mandated in several countries. Some jurisdictions call for disclosure of remuneration of a certain number of the highest paid executives, while in others it is confined to specified positions. The CMA requires that the remuneration policy especially of executive directors should include an element that is linked to corporate performance. When preparing its proposal, the committee considers, among other things, the development of director remuneration and the level of director remuneration in peer companies. The committee has underlined the importance of aligning the interests of directors with those of shareholders and prefers payment of board remuneration in the form of shares.

Whether the directors put forward negative opinions on the board meeting for a period of time is used as an instrumental variable for whether the directors put forward negative opinions on the board meeting. And the company’s industry is used as an instrumental variable for directors’ remuneration. Through analysis, it is found that after controlling endogeneity, the conclusion of this paper is still robust (see Table 6).

Employee Share Savings programme – forShares

Upon the recommendation of the Nomination and Remuneration Committee, the Board of Directors approves annually the compensation of the President and CEO within the confines of the Remuneration Policy for the President and CEO. The composition and duties of the Nomination and Remuneration Committee have been described in detail in the Corporate Governance Statement. In order to avoid any conflicts of interest, the Nomination and Remuneration Committee shall consist of non-executive members only.

Directors, that are members of the board of directors, are senior managers who act for shareholders to supervise or control company affairs. Historically, the duties of directors have undergone a process of development and evolution. Before the 1870s and 1880s, in the early joint-stock companies, directors were those who represented shareholders to manage and supervise the operation of the company. The special decree passed by the British Parliament in 1844 clearly stated that the director is the person who directs, handles and supervises the affairs of the company. After the Second World War, the management function of the board of directors gradually faded and became a leading and supervisory agency.

In addition, each member will be paid EUR 750 per meeting of the Board attended, the Chair’s meeting fee being double this amount. Lastly, in order to avoid conflicts of interests for remuneration consultants, it requires that consultants who advise the remuneration committee must not also advise other departments of the company. As a last resort, companies should reclaim variable components of remuneration which were paid on the basis of data which basics of accounting later proves to be manifestly misstated. The Board of Directors approves the participation of the Fortum Leadership Team members in each annually commencing LTI plan. Subject to a decision by the Board of Directors the President and CEO is authorised to decide on individual participants and potential maximum awards for other participants than the Fortum Leadership Team in accordance with the nomination guidelines approved by the Board of Directors.

- Fortum’s STI programme is designed to support the achievement of the company’s annual financial, strategic and sustainability targets.

- This paper selects the data of Shenzhen and Shanghai A-share listed companies from 2005 to 2019 for research.

- The performance measures for the 2021–2023 LTI plan are the relative TSR measured against a European utilities peer group and the ESG target, which is linked to the reduction of Fortum’s coal-based power generation capacity in line with Fortum’s coal-exit path.

- On 6 September 2022, Fortum signed a bridge financing arrangement with the Finnish state to cover the collateral needs in the Nordic power commodity market.

- The board of directors control the compensation structure of the directors and the shareholders have the authority to sue the directors in case of an overpayment.

There can be an inherent legal restriction in that directors are required to act in the best interests of the company. If the company is in financial difficulties, excessively high levels of directors’ remuneration could be considered a violation of this restriction. In listed companies, independent directors are not the only supervisors, in fact all directors are supervisors. At present, the supervision duties of independent directors are more emphasized in listed companies, while the supervision duties of non-independent directors or internal directors are ignored. Board remuneration in 2021The Annual General Meeting 2021 resolved that the Chair of the Board be paid an annual base fee of EUR 195,000, the Deputy Chair of the Board EUR 140,000 and other members of the Board EUR 115,000. The annual base fee will be paid in the company shares and cash so that approximately 40% of the fee will be paid in the company shares to be purchased on the Board members’ behalf, and the rest in cash.