Direct Debit has, historically, been difficult for SMEs to access via their bank due to onerous financial and regulatory requirements. However, now companies like GoCardless can offer a cost-effective Direct Debit service that takes care of all the legal and technical issues on your behalf, leaving you to focus on what you do best. Accepting cash and cheques on invoices is relatively unusual these days. In the past, cheques would have made up a significant portion of invoice payments, but these days they have mainly been replaced by digital payment methods.

Great credit isn’t needed

Smaller businesses may find it challenging to secure lenders willing to accept them. According to altLINE Vice President of Operations Kelley Burnett, this is one of the most common reasons small business owners choose invoice factoring. In this guide, we’ll break down all of the benefits of factoring, so you feel confident you’re making the right decision when deciding whether or not to factor your invoices. With Tata Capital Working Capital Demand Loan, you can get easy financing to pay for additional business expenses. Raise finances against your confirmed purchase orders to fund your suppliers.

Invoice Factoring vs. Discounting: What’s the Difference?

In effect, it’s like having an overdraft invoice finance facility that’s secured against your accounts receivables. http://www.geogsite.com/pageid-121-7.html, or invoice financing, is a method of debt financing for small businesses. Invoice factoring can help business owners fill the gap between when an invoice is created and when the customer actually pays.

Over-dependence on credit

- When it collects payment, it sends the money to the invoice discounting company to repay the loan.

- Olga had roles driving marketing campaigns in document automation, contracts, invoices, and agreements.

- Increase limit utilisation by getting access to good-rated corporates.

- Another advantage invoice factoring has over invoice discounting is that some companies offer non-recourse plans.

- To know whether a business is eligible or not, they need to meet with a factoring company that can go through its invoices and provide a better answer.

- The overall APR, typically 15-35%, is high compared to that of banks or online term lenders.

These will be anonymous in most cases but may still be useful in helping you decide which company to use. Talk to your accountant before making your final decision – they may have useful advice. There are different risk factors applying to http://www.kprf.org/showthread.php?t=10668 and invoice factoring.

Step 5: Receive Approval

If your business needs $10,000 upfront to buy a new printer or upgrade software, but you don’t have the budget for this, you can try factoring invoices. While the buyer is aware of the financier’s involvement in disclosed invoice discounting, the buyer wouldn’t know when the invoice discounting is undisclosed. As many firms consider this a lack of credit management, they can opt for financing without losing ownership and control of their credit. If the invoice discounter holds a reserve amount, the discounter will likely use it to cover part of the outstanding amount.

- Businesses have complete control over their ledger as factoring companies have no say in their sales ledger.

- B2BE delivers electronic supply chain solutions globally, helping organisations to better manage their supply chain processes, providing greater levels of visibility, auditability and control.

- Although invoice financing and factoring are often confused for one another, the two products differ in terms of structure and repayment process.

- Bear in mind that for smaller businesses it’s not always possible to do selective invoice discounting.

Avail Leasing solutions

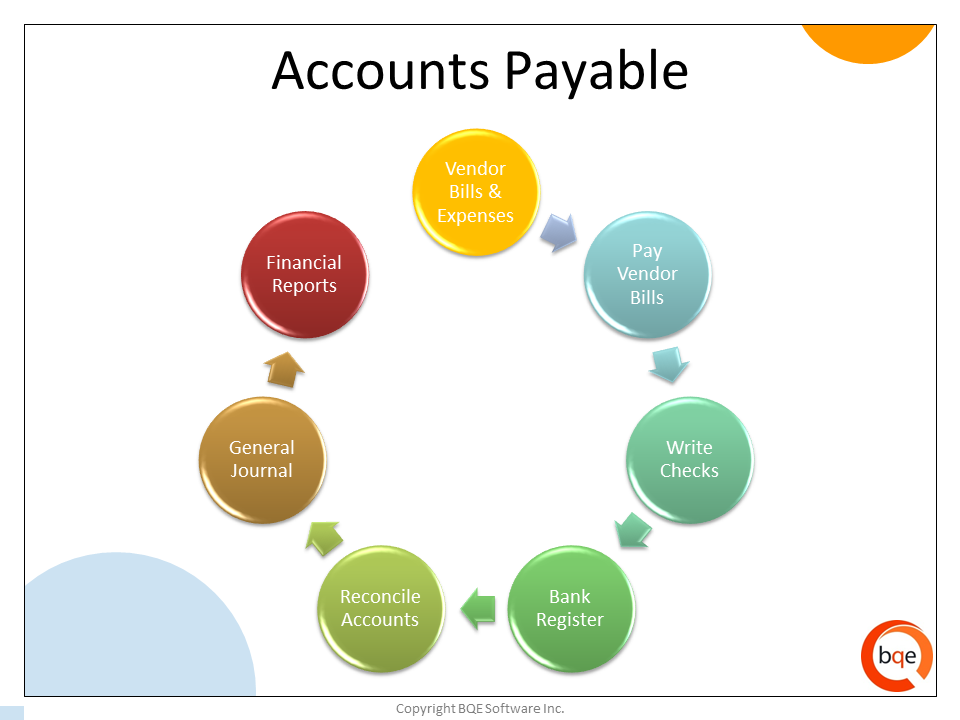

Invoicing as a billing method can offer advantages and disadvantages to businesses; however, the crucial point for businesses is how invoice payments are collected. The payment method that a company accepts on their invoices will determine whether invoicing is beneficial or a bottleneck to business growth. First, you need to determine whether you want invoice discounting on all of your unpaid invoices. You can choose to receive a loan on your total invoice value or just a portion of it.

Let us find the right factoring company for your business

If the rating isn’t up to snuff, your invoice factoring request might be denied. While invoice factoring is, at its core, a business practice like any other, some might find that it has a dark past. Certain lenders have been known to take advantage of clients with confusing language and dodgy practices, though industry standards have since evolved for more https://www.hitlist.ru/s/shakira-loca transparent transactions. Invoice financing often makes sense when a business needs to get funding more quickly and can’t qualify for less expensive financing. It may also be an option for small business owners who have a harder time qualifying for financing due to the industry they’re in, time in business, credit scores or other qualifying factors.

Complete Control

With invoice discounting, customers won’t know you’re working with a finance provider. This allows you to maintain your trustworthiness and a positive relationship with customers. As the factoring company provides financing in exchange for the right to collect payments on the invoices, it can be seen as a loan. Improved Cash FlowOne of the benefits of opting for invoice discounting is that it provides immediate access to cash that businesses can use to fulfill their short-term financial obligations.

Invoice discounting circumvents the waiting period and gives you access to the money now. B2BE delivers electronic supply chain solutions globally, helping organisations to better manage their supply chain processes, providing greater levels of visibility, auditability and control. We’re driven by a passion for what we do, inspired by innovation, and underpinned by a wealth of knowledge. With over 20+ years of experience, the B2BE teams operate worldwide. The first step to invoice discounting is to determine if it is needed.