Utilizing a free invoice template is instrumental to timely invoicing. It saves time and offers an economical means to generate professional-looking invoices. https://www.bookstime.com/ With a well-structured invoice template, you can focus on your core freelance work without worrying about the nitty-gritty of creating invoices from scratch.

Offering Multiple Payment Methods

This way you’ll always have some cash on hand to power through the waiting periods. An invoice due date states when you expect the client to pay the invoice. Watching the money growing in your business account is thrilling. I HIGHLY recommend working with HoneyBook (if you’re US-based) or Bonsai (if you’re based outside the US) to send invoices through.

Invoice as a private person in the UK

While hiring a tax accountant may entail additional costs, the benefits they provide can far outweigh the investment. Consider consulting with a tax professional to determine the best approach for managing your freelance taxes. Just like you have to take the initiative to find work, you need that same mindset to plan ahead for filing small business taxes—like income tax and self-employment tax. Though, in present-day transactions, emailing invoices seems to be the more popular method. Sending invoices via mail also helps in cases where the client claims to have lost the paper invoice. Note that the invoice raised and signed can always be used as proof in case of payment delays.

How to Make an Invoice As A Freelancer: A Step-By-Step Guide

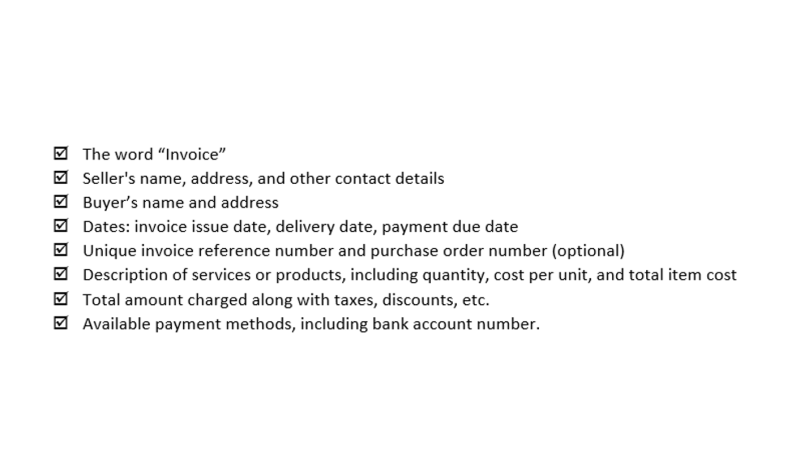

Include the total invoice amount immediately after your breakdown of services section. The breakdown of services section is where you provide a detailed description of the work you’ve done and the amount you’re charging for it. The invoice number helps you keep track of your invoices and stay organized even when working with multiple clients.

- Once you’ve chosen your preferred template, you can then edit it.

- It’s easy to miss small details when you’re putting together an invoice for the first time.

- Just upload your form 16, claim your deductions and get your acknowledgment number online.

- Cross-border operations are a norm for most freelancers (since you can digitally reach clients from any point on the planet).

- These systems typically include other features as well that are useful to freelancers, such as time-tracking.

- Besides getting clients, figuring out how to invoice as a freelancer is probably one of the most challenging parts of starting work as a freelancer.

Claiming tax deductions can help you cut costs during tax season. However, similarly to estimating your tax liability, be careful not to overestimate freelancer tax deductions to avoid penalties. If your breakdown of services includes a number of items, show what each of those items cost.

- After you gather your business income and determine your tax payments, you’ll get to identify which freelance tax deductions apply to your business.

- The only difference when it comes to freelancer designers is the cost of raw materials that goes into a particular project.

- And sure, if that’s easy enough for you to do with your invoices, by all means, make ’em look pretty.

- From there, you can choose to create one yourself using a document-creation tool, use a template, or go the easy route and use software.

- If the client hired you for a number of services, add each one to a new line so it’s easy to digest.

Many freelancers choose not to pay for invoicing software, but it can be a helpful tool if you send multiple invoices a month. If you typically only send a handful of invoices each month, you can save some money by generating free invoices on your own. A clear and professional invoice not only communicates your value to clients but also helps maintain a positive working relationship. It’s crucial that your name, address, email, and phone number are clearly stated on the invoice. This is useful in case of any conflicts or issues with the stated amount or payment methods.

Including a personalized message will help build a friendly working relationship with the client and make them more likely to seek out your freelance services in the future. You’ve got to do your part when it comes to getting paid on time, and this includes making sure your invoice is on point. When it comes to invoicing, you only have to get it right once, how to invoice as a freelancer and the rest will fall in place. Creating an invoice with the InvoiceOwl is way easier than the conventional method. And once you have designed a unique template, creating an invoice out of that template is just like filling out a form. As a bonus, we will provide you with a freelancer invoice perfect for making invoices in just a matter of a few minutes.

How to Generate Your Own Invoices

If your client has to get approval for your work from someone at their company, this clarity will help that happen faster. Make sure you keep track of your initial contract so that you can be follow agreed terms when you are creating the invoice. The most important information on the invoice is the breakdown of good and services you provided. Once the invoice is late, the client has to put in more effort in recalling the details of the business they had with you and it just takes longer to get your invoice clear. Read our helpful guide on how to start a business in Lithuania from the UK, including info on Lithuania company formation, legal entity types and more.

Final invoice

Now that you can confidently write an invoice, it’s time to send it. Whether it’s a PDF file or a link, you know that just shooting over an invoice with no context would be strange at the least. At the same time, asking for payment can sometimes feel awkward even though you know they’re expecting it. So, if you’re not sure what to write, here’s an email template to get you started.